Securing cryptocurrency wallets requires implementing fundamental practices that investors routinely ignore despite their meticulous market analysis. Strong, unique passwords through reputable managers, two-factor authentication via authenticator apps (never SMS), and offline seed phrase storage in metal cards or safety deposit boxes form the foundation. Multi-signature wallets distribute risk across multiple keys, while hardware wallets from trusted vendors provide cold storage security. The sophisticated strategies that follow these basics reveal why wallet protection demands the same rigor applied to portfolio construction.

Why do cryptocurrency investors who meticulously analyze market volatility, regulatory frameworks, and tokenomics often treat wallet security with the same casual indifference they might reserve for choosing breakfast cereal?

This puzzling disconnect between analytical rigor and security negligence represents perhaps the most expensive oversight in digital asset management.

The gap between meticulous market analysis and careless wallet security creates crypto’s most financially devastating contradiction.

Password management forms the foundational layer of cryptocurrency security, yet investors routinely violate basic principles with alarming frequency.

Strong, complex passwords must be paired with reputable password managers that generate unique credentials for each account—a practice that somehow remains revolutionary despite decades of cybersecurity breaches.

The temptation to reuse passwords across platforms (because remembering “Crypto123!” feels manageable) creates cascading vulnerabilities that would make any risk management professional weep.

Two-factor authentication represents the second critical defense mechanism, though many investors treat it as an optional inconvenience rather than essential protection.

Authenticator apps provide superior security compared to SMS-based verification, which remains vulnerable to SIM-swapping attacks—a technique that transforms your phone number into someone else’s key to your digital vault.

Seed phrase storage requires an almost paranoid level of caution.

These recovery phrases should never exist in digital form, instead residing in secure offline locations such as metal storage cards or safety deposit boxes.

Creating multiple backups prevents the nightmare scenario where a house fire simultaneously destroys both your hardware wallet and your recovery phrase written on that sticky note. Seed phrases generate the private keys that provide access to your cryptocurrency, making their protection absolutely critical for wallet security.

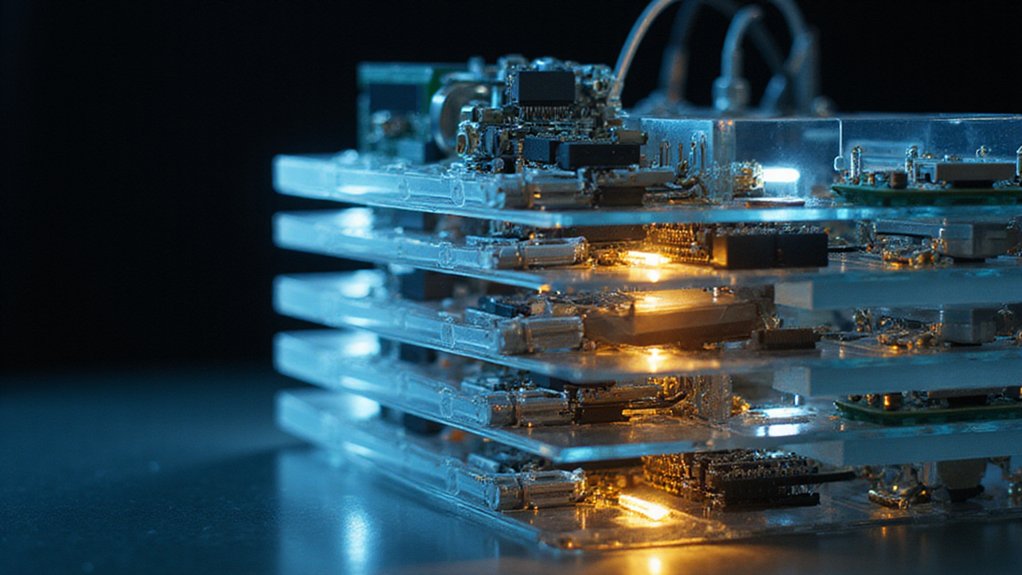

Multi-signature wallets offer institutional-grade security by requiring multiple private keys to authorize transactions.

This approach distributes risk across different devices or trusted parties, making unauthorized access exponentially more difficult.

Unlike traditional financial systems, public blockchains provide no transaction reversal capabilities or fraud protection mechanisms when security breaches occur.

Phishing protection demands constant vigilance in an environment where sophisticated scammers craft increasingly convincing replicas of legitimate platforms.

Verifying sources, scrutinizing URLs, and maintaining updated software represent basic hygiene practices that many investors mysteriously abandon when excitement over potential gains clouds judgment. Hardware wallets should only be purchased from trusted vendors, avoiding third-party marketplaces where counterfeit devices pose significant security risks.

The hot-cold storage balance requires thoughtful risk management.

Hot wallets should contain only funds needed for immediate transactions, while the majority of holdings belong in cold storage hardware wallets—devices that remain disconnected from the internet’s endless parade of threats.

Frequently Asked Questions

What Happens to My Cryptocurrency if I Forget My Wallet Password?

When cryptocurrency wallet passwords vanish from memory, the funds become permanently inaccessible—a rather unforgiving feature of decentralized finance. Unlike traditional banking’s safety nets, no central authority exists to reset credentials or recover assets. The private keys controlling those digital holdings remain encrypted behind the forgotten password, effectively transforming valuable cryptocurrency into digital archaeology. With an estimated $140 million in Bitcoin already locked away forever, password amnesia proves costly in the extreme.

Can I Recover My Funds if My Hardware Wallet Gets Physically Damaged?

Yes, hardware wallet damage needn’t spell financial doom—provided one has safeguarded their seed phrase (those 12-24 words generated during initial setup).

This BIP39-compliant recovery mechanism allows fund restoration on any compatible device or software wallet.

Simply input the original seed phrase into replacement hardware, and voilà—complete account recovery.

The real tragedy? Those who’ve neglected this fundamental backup step, effectively transforming their “secure” hardware into expensive digital paperweights.

How Often Should I Update My Wallet Software for Security?

Wallet software updates should occur whenever developers release them—typically monthly for hot wallets, quarterly for cold storage devices.

Hot wallets require immediate attention given their constant network exposure to evolving threats, while cold wallets (being offline) afford users slightly more scheduling flexibility.

Ignoring updates effectively transforms one’s supposedly secure vault into a sitting duck for known exploits, which seems counterproductive given the entire premise of cryptocurrency self-custody.

Are Cryptocurrency Wallets Insured Against Hacks or Theft?

Cryptocurrency wallets receive limited insurance coverage, primarily through custodial services like exchanges rather than individual protection.

Coverage typically applies only when custodians themselves suffer breaches—not user negligence or lost private keys.

Unlike traditional banking’s FDIC protections, crypto insurance remains spotty and expensive.

Historical incidents like Bitfinex demonstrate most users absorb significant losses without coverage, making robust security practices (including those regular software updates) more essential than insurance promises.

Can Someone Access My Wallet if They Know My Public Address?

No, possessing someone’s public address alone cannot grant wallet access—rather like knowing someone’s postal address doesn’t open their front door.

Public addresses serve exclusively for receiving transactions and viewing blockchain activity.

The corresponding private key (the actual “key” to funds) remains necessary for any spending or transfers.

However, address exposure does compromise privacy, potentially revealing transaction patterns and holdings—hardly ideal for those preferring financial discretion over transparency.