User sovereignty in cryptocurrency represents the principle that individuals maintain complete control over their digital assets through direct ownership of private keys, eliminating traditional financial intermediaries. This revolutionary concept requires users to independently manage wallets and accept full responsibility for asset security—a paradigm shift that transforms wealth management from institutional dependency to personal accountability. While offering unprecedented financial autonomy and privacy, user sovereignty demands technical proficiency that many find intimidating, creating an ironic industry of custodial services designed to circumvent the very independence cryptocurrency promised, though the deeper implications reveal fascinating tensions between human nature and technological idealism.

The revolution of cryptocurrency promised to liberate users from the traditional financial system’s intermediaries, yet the concept of user sovereignty—the ability to control digital assets without relying on third parties—remains as elusive as it is foundational to the entire digital asset ecosystem.

At its core, user sovereignty demands that individuals manage their private keys and digital wallets independently, embracing self-custody while accepting the sobering reality that one misplaced seed phrase can transform a digital fortune into an irretrievable memory.

The unforgiving mathematics of cryptography means a single forgotten phrase can erase wealth as definitively as fire consumes paper.

This paradigm shift places unprecedented responsibility on users who must navigate the treacherous waters of cryptographic security without the safety nets that traditional banking provides.

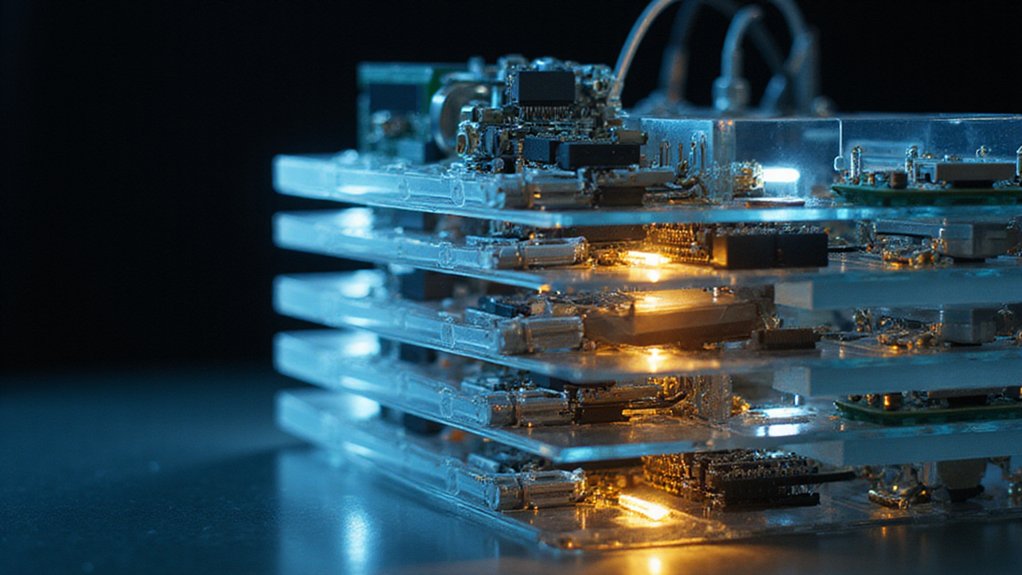

The blockchain technology underlying cryptocurrencies enables this decentralized control, supported by smart contracts that automate transactions and decentralized exchanges (DEXs) that facilitate trading without intermediaries—assuming users possess the technical acumen to avoid costly mistakes.

The benefits appear compelling: complete financial autonomy, enhanced privacy through direct blockchain transactions, and resilience against centralized system failures.

Users can employ advanced cryptographic methods to secure their assets while participating in the burgeoning decentralized finance (DeFi) ecosystem that thrives on sovereign participation. Protecting these digital assets requires implementing hardware wallets alongside other security measures to prevent unauthorized access to private keys.

The innovation potential seems limitless when individuals control their financial destinies without institutional gatekeepers.

However, the challenges prove equally formidable.

Regulatory uncertainty looms large as governments grapple with frameworks that may restrict cryptocurrency use, potentially undermining sovereignty itself.

The complexity of managing private keys and wallets demands technical knowledge that many users lack, while scalability issues question whether current blockchain infrastructure can support widespread sovereign adoption efficiently. These technical barriers can exacerbate social inequalities by excluding those without reliable internet access or digital literacy.

Self-sovereign identity (SSI) emerges as a complementary concept, allowing users to control their digital identities alongside their assets through decentralized identity management systems integrated with blockchain technology.

This dual sovereignty over both wealth and identity represents the ultimate expression of digital autonomy.

The irony remains palpable: a technology designed to eliminate intermediaries has spawned an entire industry of custodial services catering to users who find true sovereignty too intimidating.

Perhaps the greatest challenge to user sovereignty isn’t technical limitations or regulatory interference, but human nature’s persistent preference for convenience over control—even when control represents the very essence of cryptocurrency’s revolutionary promise. Meanwhile, entities operating in the cryptocurrency space must develop risk-based compliance programs to navigate the complex regulatory landscape while maintaining the principles of user sovereignty.

Frequently Asked Questions

What Happens to User Sovereignty When Cryptocurrency Exchanges Get Hacked?

When exchanges suffer breaches, user sovereignty effectively evaporates—users lose control over their assets, trapped in limbo while platforms scramble to contain damage.

The irony proves particularly acute: individuals seeking financial independence through cryptocurrency find themselves powerless spectators to their own wealth’s disappearance.

Recovery depends entirely on exchange competence and goodwill (hardly reassuring odds).

This stark vulnerability exposes the fundamental tension between centralized convenience and true asset autonomy.

Can Governments Completely Override User Sovereignty in Cryptocurrency Systems?

Governments face considerable technical limitations when attempting complete sovereignty override in cryptocurrency systems.

While regulatory frameworks effectively constrain centralized exchanges and custodial services, truly decentralized networks resist direct governmental control—private key holders retain ultimate authority over their assets.

However, governments wield substantial indirect influence through infrastructure control, regulatory compliance requirements, and surveillance technologies, creating a complex dynamic where complete override remains technically infeasible yet user autonomy faces persistent erosion.

How Does User Sovereignty Differ Between Bitcoin and Ethereum?

Bitcoin and Ethereum offer comparable user sovereignty through self-custodial private key management, though their architectural differences create distinct experiences.

Bitcoin’s limited scripting requires consensus changes for new features, while Ethereum’s smart contract flexibility enables programmable sovereignty tools—multisig wallets, social recovery mechanisms, and decentralized applications.

Ethereum’s ENS provides readable addresses without compromising pseudonymity, whereas Bitcoin relies on external solutions.

Both preserve user control, but Ethereum’s programmability offers more sophisticated sovereignty implementations.

What Are the Main Risks of Having Complete User Sovereignty?

Complete user sovereignty transforms individuals into their own banks—with all the attendant responsibilities and perils.

Technical mishaps (lost keys, phishing attacks) result in irreversible asset loss, while regulatory uncertainty creates legal minefields.

Users face market volatility without deposit insurance, navigate complex DeFi protocols prone to smart contract failures, and assume complete operational burden for security, backups, and transaction management—essentially trading institutional safeguards for absolute control.

Is User Sovereignty Possible With Central Bank Digital Currencies?

User sovereignty within CBDCs remains fundamentally constrained by their centralized architecture.

While token-based designs might offer marginal improvements over account-based models, central banks retain ultimate control over issuance, governance, and transaction oversight.

The inherent tension between regulatory compliance requirements—user identification, transaction monitoring, policy interventions—and true user autonomy creates an irreconcilable conflict.

CBDCs may enhance payment efficiency, but genuine sovereignty? That would require abandoning the very centralized control mechanisms that define their existence.