Cryptocurrency mining involves specialized hardware solving complex mathematical puzzles to verify blockchain transactions and earn digital rewards. Beginners face choices between ASICs (maximum efficiency, limited flexibility) and GPUs (versatile but less powerful), while managing operational complexities including cooling systems, power requirements, and mining pool configurations. Profitability depends on electricity costs, hash rates, and volatile cryptocurrency prices—factors that frequently transform enthusiastic hobbyists into reluctant accountants. Understanding these fundamentals reveals why successful mining requires more strategic planning than initial enthusiasm suggests.

The digital gold rush of cryptocurrency mining presents an intriguing paradox: while the fundamental concept involves computers competing to solve mathematical puzzles for monetary rewards, the practical reality encompasses a labyrinthine ecosystem of specialized hardware, energy economics, and strategic decision-making that would make even seasoned investors pause.

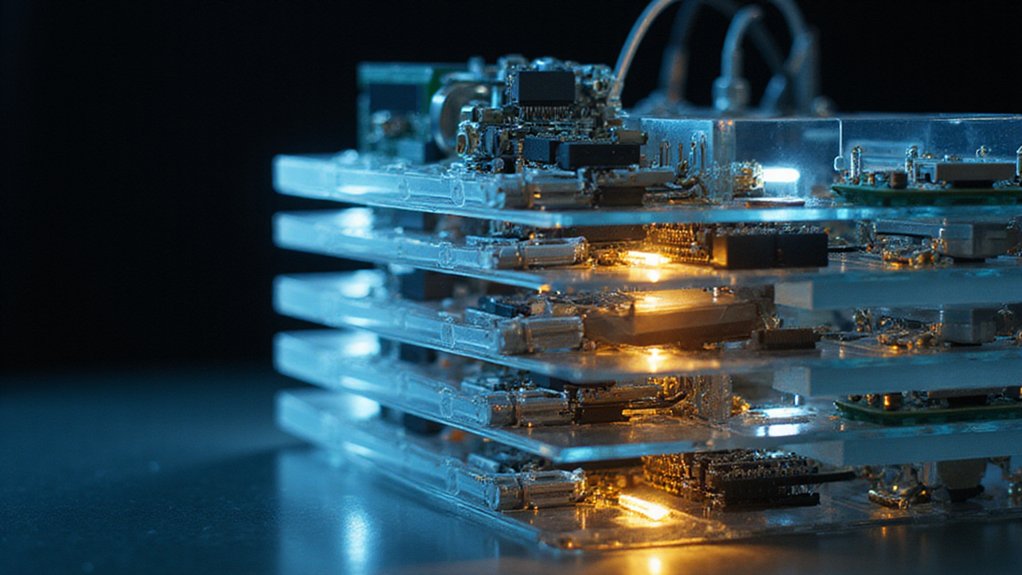

For newcomers contemplating this digital endeavor, the hardware landscape offers several paths of varying complexity.

The hardware maze awaiting crypto mining novices presents deceptively simple choices that quickly reveal themselves as bewilderingly complex financial commitments.

Application-Specific Integrated Circuits (ASICs) represent the gold standard for Bitcoin mining, delivering maximum efficiency through specialized circuitry designed exclusively for cryptocurrency calculations.

Graphics Processing Units (GPUs), meanwhile, serve altcoin miners who prefer flexibility over raw computational power—though one might question whether “flexibility” justifies the comparative inefficiency when serious money enters the equation.

The operational mechanics demand more than simply plugging in expensive equipment and hoping for profits.

Miners must navigate firmware updates, configure mining software with pool URLs and wallet addresses, and establish stable network connections through Ethernet cables (because apparently, Wi-Fi isn’t reliable enough for digital fortune-seeking).

Power supply units require careful matching to hardware specifications, while cooling systems become essential investments unless operators enjoy the distinct pleasure of watching their equipment transform into expensive paperweights.

Pool mining versus solo mining presents beginners with their first strategic decision.

Solo mining offers complete reward retention but delivers success rates so abysmal that most rational actors join mining pools, accepting small fees in exchange for steady payouts based on contributed hash power.

The mathematics here are unforgiving: individual miners competing against industrial operations might as well play lottery tickets.

Cloud mining platforms promise hardware-free participation through rented hash power, eliminating maintenance headaches while introducing counterparty risk.

Users basically bet that cloud providers will honor contracts and deliver promised returns—a proposition requiring considerable faith in entities operating in regulatory gray areas.

Profitability calculations must account for block rewards, transaction fees, energy costs, and cryptocurrency price volatility.

Hash rates determine earning potential, but electricity expenses can quickly transform profitable operations into expensive hobbies. Mining also serves as the backbone for transaction verification, ensuring each transfer’s legitimacy while preventing the same digital currency from being spent multiple times across the network. In proof-of-stake systems, validator nodes perform similar verification functions without the energy-intensive computational requirements of traditional mining.

Market fluctuations add another layer of uncertainty, because apparently, solving complex mathematical problems wasn’t challenging enough without adding speculative investment dynamics to the mix.

Frequently Asked Questions

What Are the Tax Implications of Cryptocurrency Mining Rewards?

Cryptocurrency mining rewards face double taxation—first as ordinary income upon receipt (taxed up to 37%), then capital gains upon disposal (up to 20%).

The IRS treats mining rewards as taxable income at fair market value when deposited, regardless of immediate sale intentions.

Business miners enjoy expense deductions for equipment and electricity costs, while hobby miners cannot deduct expenses through 2025, creating disparate tax treatments for identical activities.

How Much Electricity Does Mining Consume Monthly?

Bitcoin mining consumes roughly 13.3 terawatt-hours monthly—enough electricity to power entire nations like Argentina for weeks.

This staggering figure, derived from the network’s annual 160 TWh consumption, represents approximately 0.04% of global monthly energy usage.

The relentless pursuit of computational dominance drives miners toward regions offering subsidized electricity, creating an oddly symbiotic relationship between digital currency speculation and municipal power grids worldwide.

Can I Mine Cryptocurrency Using My Smartphone or Tablet?

While technically feasible, smartphone cryptocurrency mining represents more of an educational exercise than a profitable venture.

Mobile devices can run specialized mining applications for alternative cryptocurrencies (Bitcoin remains hopelessly impractical), but their limited processing power, thermal constraints, and battery drainage create substantial barriers.

The modest hash rates generated barely offset electricity consumption—previously discussed as a significant monthly expense—making cloud mining integration a more pragmatic approach for mobile enthusiasts.

What Happens When All Bitcoins Are Mined?

When Bitcoin’s 21 million coin cap is reached around 2140, miners will shift from earning block rewards to relying solely on transaction fees.

Network security depends entirely on whether these fees provide sufficient economic incentive—a rather precarious proposition.

Higher-value transactions may command premium fees, while Layer 2 solutions handle smaller payments.

The network’s survival hinges on maintaining adequate miner participation through fee-based compensation alone.

Is Cryptocurrency Mining Legal in My Country?

Cryptocurrency mining legality varies dramatically by jurisdiction, creating a patchwork of regulations that would challenge even seasoned compliance officers.

Most developed nations permit mining while imposing increasingly byzantine tax obligations and anti-money laundering requirements.

Countries like Ireland lack explicit crypto laws (refreshingly honest regulatory ambiguity), while Italy demands OAM registration and Norway inflicts punitive electricity rates.

The prudent miner researches local regulations before deploying capital into this legally evolving landscape.