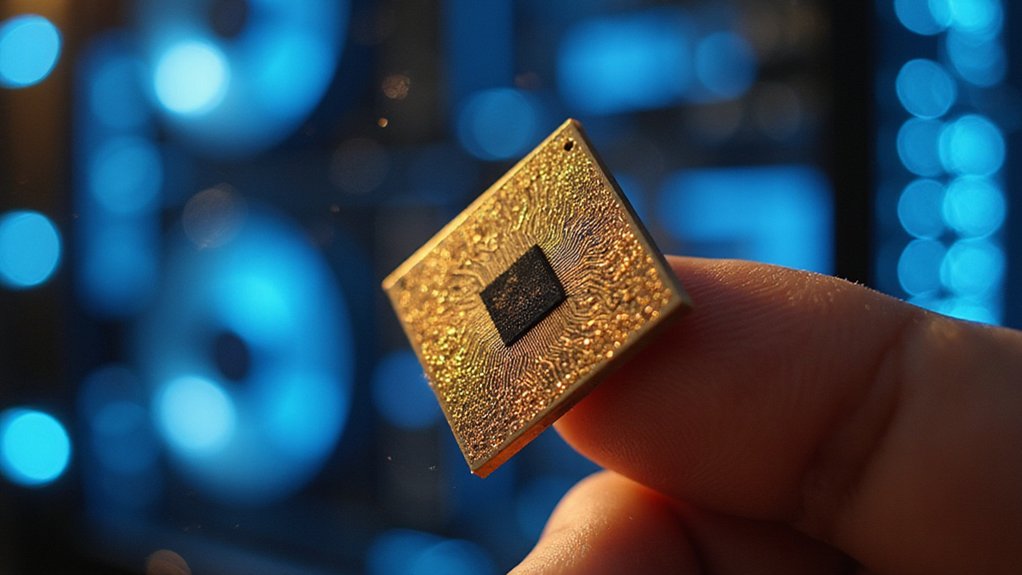

The alchemy of cryptocurrency markets has once again transformed base metals and electricity into digital gold, propelling mining stocks skyward as Bitcoin’s 20% surge in May 2025 reminded investors why they fell in love with this particular brand of financial masochism.

Mining equities have demonstrated their characteristic amplified response to Bitcoin’s price movements, with analysts suggesting these leveraged plays may actually outperform the underlying cryptocurrency itself throughout 2025—a phenomenon that would make traditional value investors reach for their smelling salts.

Mining stocks continue their volatile dance with Bitcoin, amplifying every price swing into outsized gains that would horrify conservative investors.

The mathematics underlying this euphoria reveal both promise and peril. While Bitcoin’s ascent boosted mining profitability by nearly 20% in May, the hashrate’s modest 3.5% increase suggests the network hasn’t yet attracted the flood of new capacity that typically erodes margins.

North American operations, commanding 26.3% of global mining activity, led this revenue renaissance with companies like Hyperscale Data extracting $1.9 million from 17.4 Bitcoin mined—a respectable haul in anyone’s ledger.

Yet beneath this golden veneer lurks a sobering reality: production costs have surged 34.6% in Q2 2025, catapulting beyond $70,000 per Bitcoin after climbing from $52,000 in late 2024.

Energy price inflation serves as the primary culprit, though elevated hashrate competition compounds the pressure by making each satoshi harder to earn. This cost escalation threatens to separate the wheat from the chaff among mining operations, favoring those with access to cheap electricity and efficient hardware over legacy operators clinging to outdated equipment.

Market valuations increasingly reflect investor preference for companies offering diversified revenue streams beyond pure-play mining exposure. Regulatory oversight provides an additional layer of security and transparency that attracts institutional capital seeking crypto exposure through traditional equity channels.

The sector’s future hinges on operational efficiency improvements and technological innovations that can offset rising energy costs—a delicate balancing act between expansion ambitions and margin preservation. Some miners are exploring alternative revenue streams through liquidity mining, where they provide cryptocurrency assets to decentralized platforms and earn rewards from trading fees.

Strategic fleet deployment and geographic diversification, exemplified by new facilities sprouting across Montana, represent mining companies’ attempts to capitalize on favorable conditions while they persist.

Whether this current profitability surge proves sustainable depends largely on the industry’s ability to innovate faster than costs can climb—a race that has defined cryptocurrency mining since its inception.