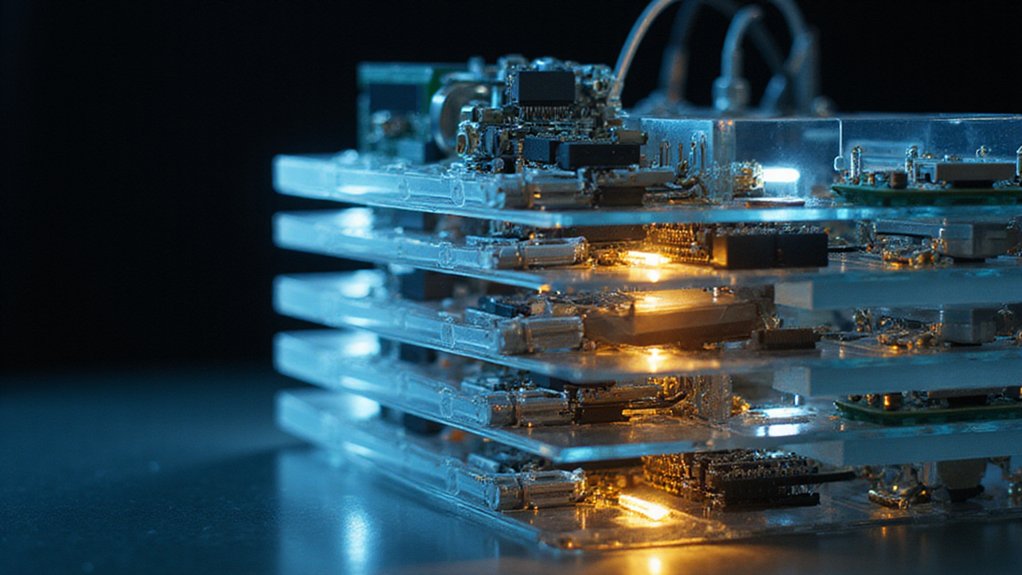

Blockchain architecture consists of five interconnected layers that transform cryptographic concepts into operational networks. The hardware layer provides computational infrastructure through nodes and mining farms, while the data layer structures transactions into immutable blocks. Network protocols manage peer communication and synchronization, with consensus mechanisms like Proof-of-Work preventing double-spending through energy-intensive validation. Advanced layers include Layer 0’s interoperability bridges, Layer 1’s base protocols, and Layer 2’s scalability solutions—though each introduces unique trade-offs worth exploring further.

The architecture of blockchain technology, much like the financial systems it seeks to disrupt, reveals itself through a carefully orchestrated hierarchy of interdependent layers—each serving distinct yet complementary functions that collectively enable the seemingly magical transformation of distributed computing power into immutable ledgers.

Blockchain’s carefully orchestrated layers transform distributed computing into immutable ledgers through an intricate hierarchy of interdependent yet complementary functions.

At the foundation lies the Hardware Layer, where individual computers masquerading as “nodes” perform the decidedly unglamorous task of decrypting and validating transactions.

These physical machines, whether solitary desktop computers or sprawling server clusters, provide the computational backbone that transforms theoretical consensus into tangible reality through peer-to-peer information sharing (though one might question whether true decentralization exists when mining farms concentrate vast computational power).

The Data Layer structures this validated information into sequential blocks, creating the immutable ledger that blockchain evangelists celebrate.

Each block contains transaction data—sender, recipient, amounts, and cryptographic keys—linked chronologically from the genesis block forward.

Bitcoin maintains simple transactional lists while Ethereum employs complex state tries, reflecting the respective networks’ ambitions and computational overhead.

Communication between these distributed nodes occurs through the Network Layer, which manages data propagation and peer discovery.

Protocols maintain session integrity while facilitating the synchronization necessary for consensus—assuming network participants remain honest actors rather than sophisticated adversaries.

The Consensus Layer implements the voting mechanisms and computational puzzles that prevent double-spending and maintain network integrity.

Whether through Proof-of-Work‘s energy-intensive mining or Proof-of-Stake‘s capital requirements, this layer determines which transactions achieve finality and which nodes participate in governance. Modern multi-chain networks separate consensus and application layers to provide unified security while enabling diverse functionalities across independent blockchain networks.

Layer 0 provides interoperability infrastructure, enabling communication between otherwise isolated blockchain networks through relay chains and bridges.

Layer 1 represents the base blockchain protocols—Bitcoin, Ethereum, and their contemporaries—where core consensus mechanisms operate and native cryptocurrencies maintain value.

Layer 2 solutions address scalability limitations through state channels, sidechains, and rollups that process transactions off-chain before settling on the main network. These scaling solutions face inherent risks as experimental networks, including potential security gaps that emerge from their dependence on underlying Layer 1 infrastructure.

Layer 3 enables cross-chain applications that facilitate complex interactions between different blockchain networks, extending functionality beyond individual protocol limitations.

These scaling solutions acknowledge what industry participants rarely admit publicly: that revolutionary blockchain technology often requires traditional infrastructure to achieve practical utility at meaningful scale.

Frequently Asked Questions

What Happens if a Blockchain Layer Fails or Becomes Compromised?

When a blockchain layer fails or suffers compromise, the consequences ripple through interconnected systems with remarkable efficiency.

Transactions stall, smart contracts malfunction, and the cherished immutability becomes surprisingly mutable.

Attackers might orchestrate double-spending schemes or 51% attacks, transforming decentralized networks into centralized playgrounds.

Financial losses accumulate while data integrity crumbles—though one might wonder how “trustless” systems require such extensive trust in their underlying infrastructure’s resilience.

How Much Does It Cost to Develop Applications on Different Blockchain Layers?

Development costs vary dramatically across blockchain layers, with Layer 1 applications requiring $20,000-$200,000 due to gas fees and consensus overhead. Layer 2 solutions add $15,000-$40,000 in integration complexity but reduce ongoing transaction costs—a classic pay-now-or-pay-later scenario. Private enterprise blockchains demand upfront investments exceeding $200,000 for customization, while application-specific costs range from $40,000 for basic dApps to $500,000+ for DeFi platforms requiring extensive security audits.

Which Blockchain Layer Is Best for Beginners to Start Building On?

Layer 2 solutions emerge as the ideal entry point for beginners, offering dramatically reduced transaction costs (up to 95% savings on gas fees) while inheriting Layer 1 security properties.

Arbitrum and Polygon provide affordable experimentation environments with robust developer tooling.

However, purists seeking fundamental blockchain comprehension should consider Ethereum’s Layer 1 ecosystem first—despite the financial burden—before migrating to Layer 2’s more forgiving economic landscape.

Can Blockchain Layers Communicate With Traditional Banking Systems and Databases?

Blockchain layers readily communicate with traditional banking systems through APIs and middleware solutions, creating hybrid architectures that preserve existing infrastructure while adding distributed ledger capabilities.

Banks typically adopt phased integration approaches—hardly revolutionary, given their legendary caution—enabling faster settlements, reduced costs, and enhanced transparency.

However, regulatory complexity and scalability concerns persist, requiring thorough testing and staff training to guarantee seamless interoperability between immutable ledgers and legacy databases.

What Are the Energy Consumption Differences Between Various Blockchain Layer Implementations?

Energy consumption across blockchain layers reveals stark disparities that would make utility executives either weep or rejoice.

Layer 1 implementations span from Bitcoin’s country-sized appetite (131-200 TWh annually) to Cardano’s modest 0.003 TWh consumption—a difference of roughly 99.9%.

Layer 2 solutions naturally inherit their underlying chain’s efficiency profile, while the consensus mechanism remains the primary determinant: Proof-of-Work networks devour energy like digital gluttons, whereas Proof-of-Stake alternatives sip power comparatively.